下载APP

【简答题】

Technology is the application of knowledge to production. Thanks to modern (S1) ______ we have been able to increase greatly the (S2) ______of our work force. New machines and new methods have helped (S3) ______ down time and expense while increasing overall out put. This has meant more production and a higher standard of living. For most of us in America, modern technology is thought of as the (S4) ______ why we can have cars and television sets. Furthermore, technology has also (S5) ______ the amount of food available to us, by means of modern farming machinery and animal breeding techniques, and has extended our life span via medical technology. Will mankind continue to live longer and have a higher (S6) ______ of life To a great extent, the answer (S7) ______ on technology and our ability to use it widely. (S8) _______________________ The advancement of technology depends upon research and development, and the latest statistics show that the United States is continuing to pump billions of dollars annually into such efforts. So while we are running out of some scarce resources, (S9) _______________________. Therefore, in the final ysis the three major factors of production -- land, labor and capital -- are all influenced by technology. When we need new skills on techniques in medicine, people will start developing new technology to meet those needs. (S10) ____________________. S3

举报

参考答案:

参考解析:

刷刷题刷刷变学霸

举一反三

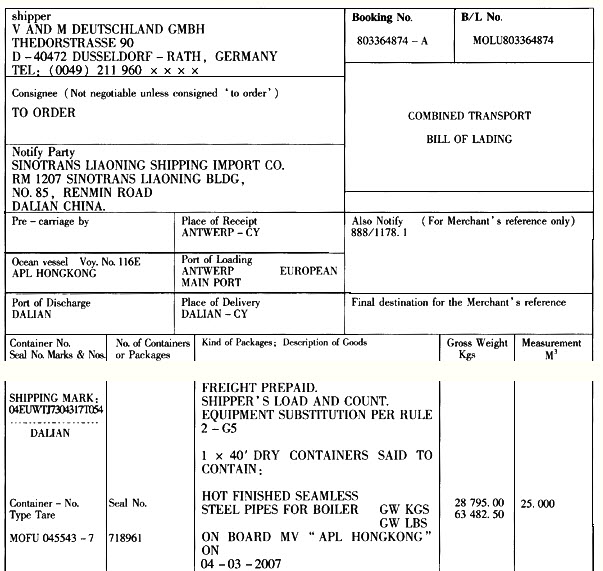

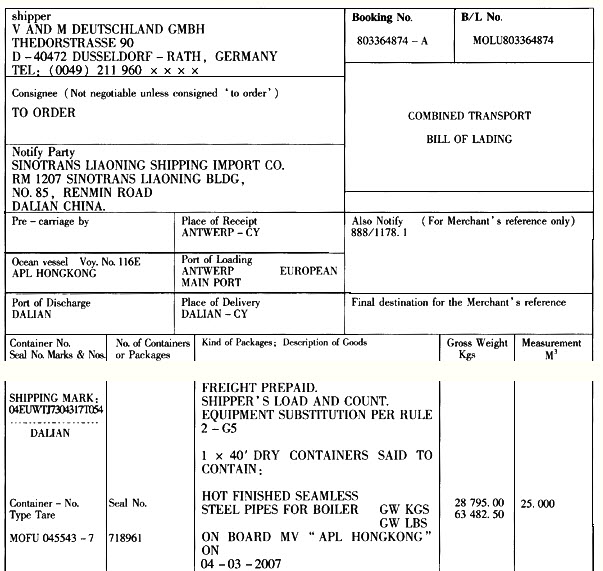

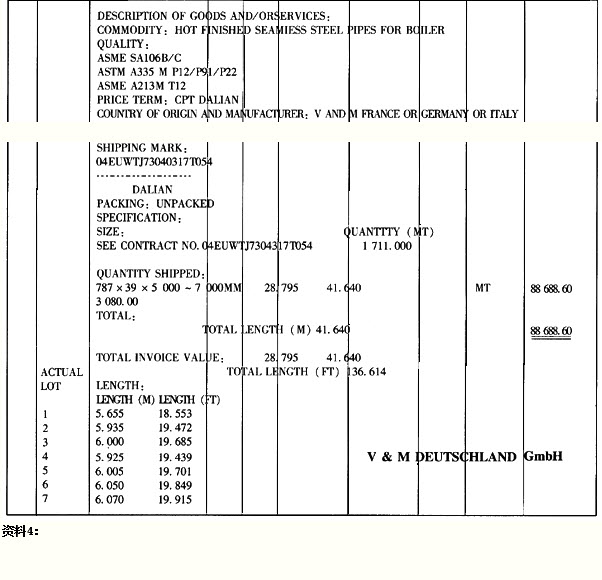

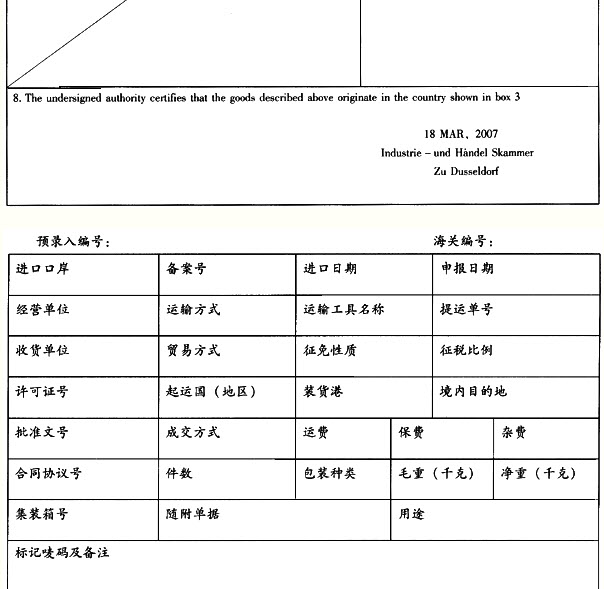

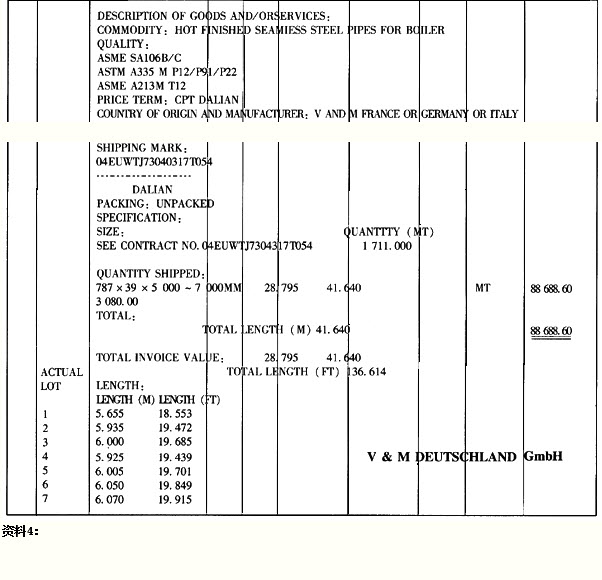

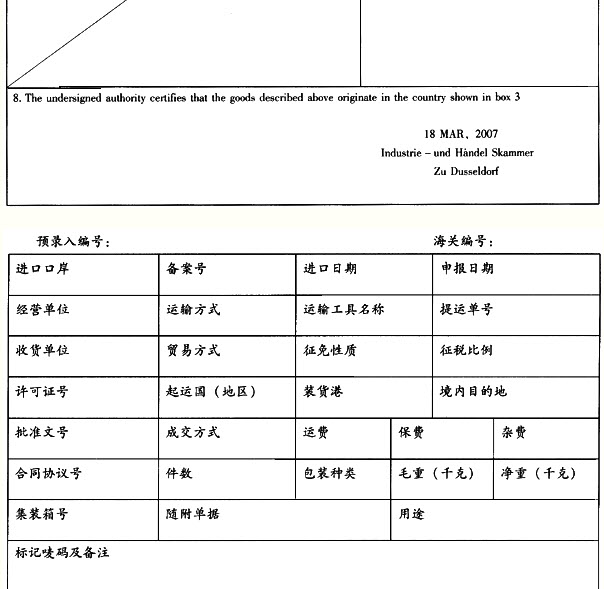

【单选题】“数量及单位”栏应填()。 A.28 795千克 (第一行) B.28 795千克 (第一行) 41 640米 (第三行) C.28 795千克 (第一行) 63 482.5磅 (第三行) D.28 795千克 (第一行) 28.795吨 (第三行)

A.

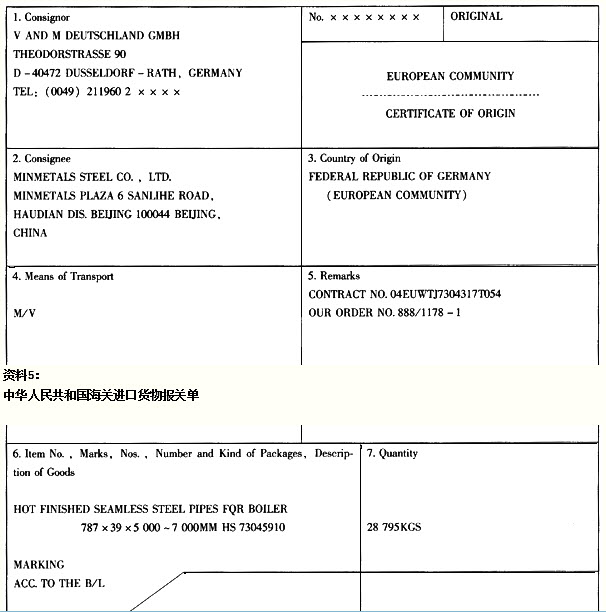

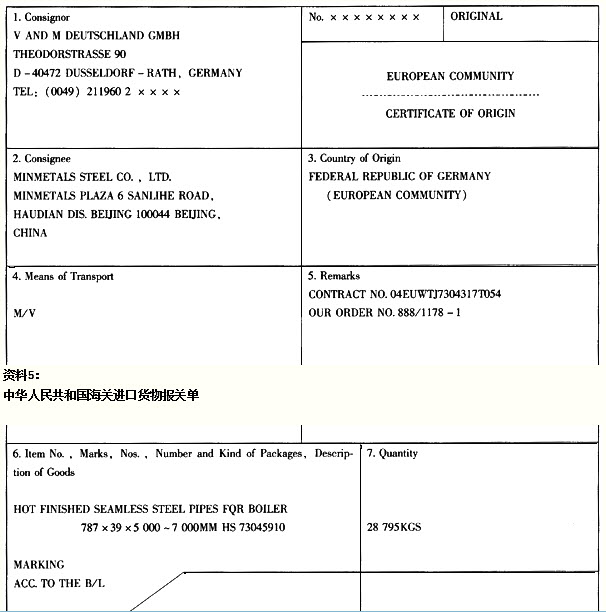

请根据所提供的资料,按照报关单填制规范的要求,在报关单相对应的栏目选项中,选出最合适的答案。

B.

资料1:

C.

中国矿产钢铁有限责任公司(110891 ××××)订购进口一批热拔合金钢无缝锅炉管(属法定检验检疫和自动进口许可管理商品,法定计量单位为千克),委托辽宁抚顺辽抚锅炉厂有限责任公司(210491××××)制造出口锅炉。载货运输工具于2007年4月10日申报进境,次日辽宁龙信国际货运公司(210298××××)持经营单位登记手册和相关单证向大连大窑湾海关申报货物进口。保险费率3‰。

D.

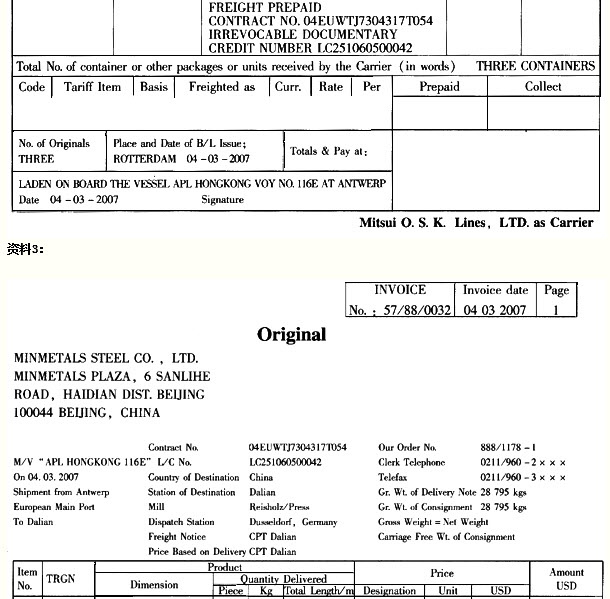

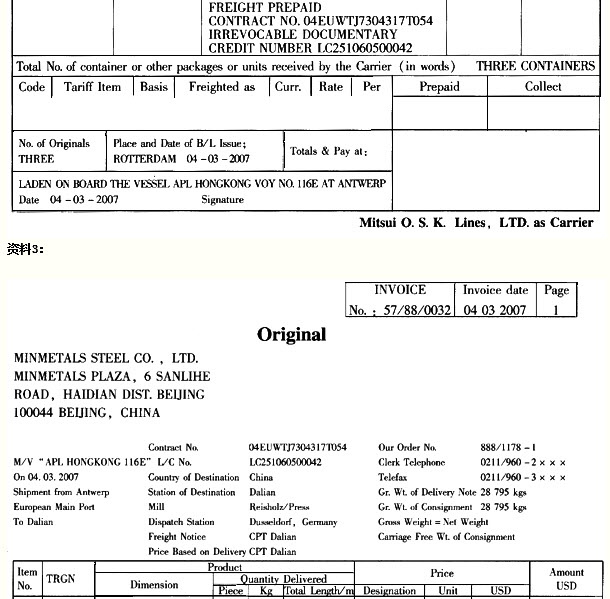

资料2:

E.

Mitsui O.S.K. Lines,LTD.

F.

G.

H.

请根据以上资料,选择下列栏目正确选项:

【单选题】辅导期一般纳税人增购专用发票预缴增值税的处理,下列陈述不正确的是( )。

A.

纳税人在辅导期内增购专用发票,继续实行预缴增值税的办法,预缴的增值税可在本期增值税应纳税额中抵减,抵减后预缴增值税仍有余额的一次退还

B.

辅导期纳税人专用发票实行按次限量控制,主管税务机关每次发售发票数量不超过25份

C.

主管税务机关应在纳税人辅导期结束后的第一个月内,一次性退还纳税人因增购专用发票发生的预缴增值税余额

D.

实行纳税辅导期管理的小型商贸企业,领购专用发票的最高开票限额不得超过10万元

【单选题】醛酮类成分( )

A.

Na2SO3

B.

1% HCl或H2SO4

C.

GirardT或GirardP

D.

丙二酸单酰氯

E.

2% NaOH

F.

从挥发油乙醚液中分离得到下列成分,应加入